As you probably already know that buying bullion has always been considered as an optimal way to diversify one’s investment portfolio and this is due to the fact that although prices of investment metal may go down, it eventually goes up.

However, have you asked yourself this question, if the prices of precious metals are certain to rise, then why do investors still lose money when they buy bullion? The answer lies in ‘time’ and price. Sometimes it is not about simply buying and owning bullion or bullion related stocks, it is also dependent on when you buy it, how much you bought it for and how long can you hold on to it.

For instance those who bought bullion in when gold prices were at record highs (1800 per ounce) are actually still holding on to their bullion due to the fact that they bought these investments at a relatively high price, with the hopes of it going higher, however as the economies of the world stabilised, the prices of gold started sliding and those who cut losses at an early stage were few as a majority of them held on, thinking that the prices of gold will rise again, it will, but not just yet.

Recently, when Greece defaulted in its payments and the sudden drag on the Chinese economies also caused a buying spree on the precious metal market platform, this was due to the fact that many investors thought that these economic and financial turmoil would cause the prices of bullion to rally, they were wrong and those who purchased the precious metal a month ago and still jotting down losses in their balances. The common perception is that the moment there is economic turmoil, prices of gold would rise as investors lose faith in the financial systems, this assumption is not only dead wrong, but it is also totally illogical.

The point of investing is to make profits and thus unless there is a significant or sufficient evidence that the financial system is in grave trouble, most seasoned investors will hold on to their stock and not switch focus. What is the point of letting a good investment go only because Greece is in trouble? In fact the prices of gold fluctuated even further due to the lowered interest rates that made capital markets more appealing than the precious metal market.

In order to reap profits out of bullion, novice investors should be aware of a few key facts; gold related investments are marred by a complex system that could affect investments drastically indirectly. A simple example of this scenario would be stocks related to mining companies, although the prices of gold increase which is good for the mining company, the company itself might be faced with issues such as low output and increased costs.

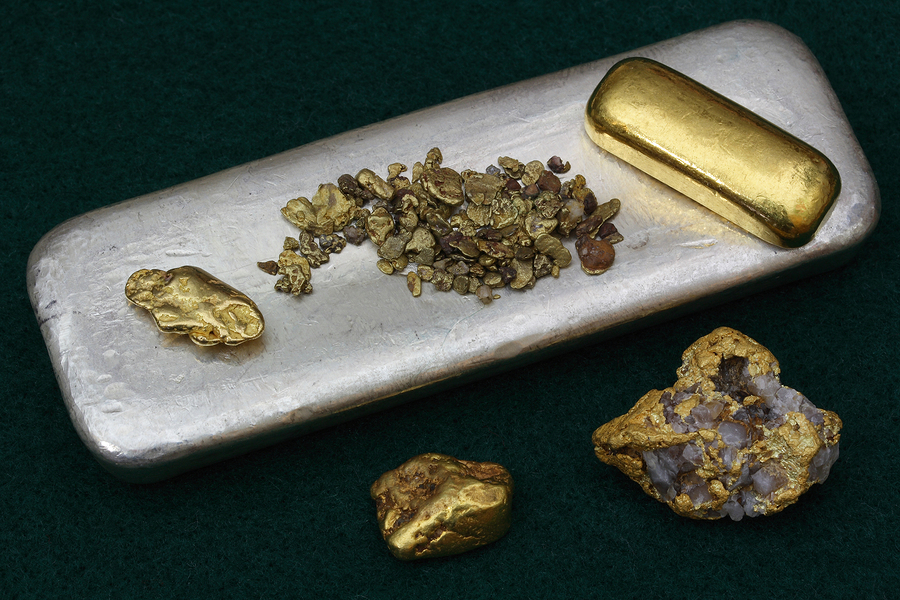

Thus the best way to invest in bullion and maintain a positive balance is to buy the bullion physically and keep it in a manner that it becomes accessible to you at any time you want to sell it, keeping bullions with vault operators also increases cost and to make matters worse, most gold traders only offer prices that are slightly below market prices (most of them only sell at market prices, but usually buy bullion at an average of 5 % below the market rates.

This means that you would only be able to make a profit after you factors the costs that you will incur not only when you buy bullion but also when you sell bullion. Ensuring that the buyers are transparent when conducting business is an essential factor, which means, that if you are planning to invest in gold, then it would be wise that you start looking for gold buyers and have a discussion with them prior to your purchase.