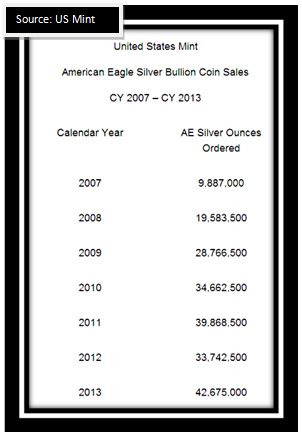

The table on the left shows the sales figures for the American Eagle Silver Bullion and the fact that the demand for it has risen by more than 400 % over the last 6 years does not mean that the prices of silver has risen in the same perspective, but it however has increased from +/- $ 12.50 in 2007 to +/- $ 20.00 this year which shows a steady trend of increment of 10 % / annum. Analysing the demand for the American Eagle Silver Bullion Coin sales figures, gives us an insight of how the economy is fairing.

Just like gold, a sudden paramount increase in the prices of silver is an unhealthy sign of the economy, however the steady increase of the prices of silver that is matched by the rise in demand tells us that the economy is sailing on calm waters. The fact that the prices of silver and gold are linked closely to inflation and the destruction of the all mighty dollar is not as correct theoretically as most of us are led to believe because inflation could also be easily fuelled as governments increase their money supplies to pay of surpluses which

happens frequently because governments print money irresponsibly for short term

commitments while their GDP output remains status quo.

These frequent occurrences over the past 2 decades whereby governments print large

amounts of paper currency to offset their deficits eventually remit their countries of into the

void of hyperinflation. It is somewhat a common belief that when interest rates are

decreased or in the even the governmental budgets are running on deficits the value of

money for that government falls rapidly and that the best defence to overcome the problem

is if these governments buy gold or silver to stem the loss of their currency’s purchasing

power.

This belief is blurry in definition because in a practical sense based on the inflation hedge

theory this not only brings about the loss in purchasing power because of increase in

prices of basic goods, but it also affects the currency in the global arena due to the

differences in exchange rates that become unfavourable to those who are holding the

dollar and the lack of demand for that currency sends the value spiralling down even

further.

The reason for all this is due to the fact that both gold and silver are used by mining

companies for contracts as well as manufacturers of end user products and products using

silver in industrial materials speculate on the precious metal as part of their risk mitigation

policies making or turning silver into an investment portfolio.

The biggest industrial use for silver is in the photographic, jewellery, and electronic entities

of the world. Electronics have become the centre of most other industries such as

automobiles, entertainment and communications which makes silver in essence a much

more stable precious metal due to the adequate quantity that it is found in. Mexico, Peru

and China are the biggest silver producers in the world.

About this article: M.A.K Precious Metals Australia is a Melbourne Gold Buyer and Refiner.

For more information please visit their website at www.makpreciousmetals.net.au.